Quick Commerce Street Fights : Battle for Every Minute

Kem Cho, Readers! 🙏

It’s been so long since I last set foot in a Dmart for chips, biscuits, or snacks that I half expect to be greeted with a “Welcome back!” as if I’m a long-lost relative.

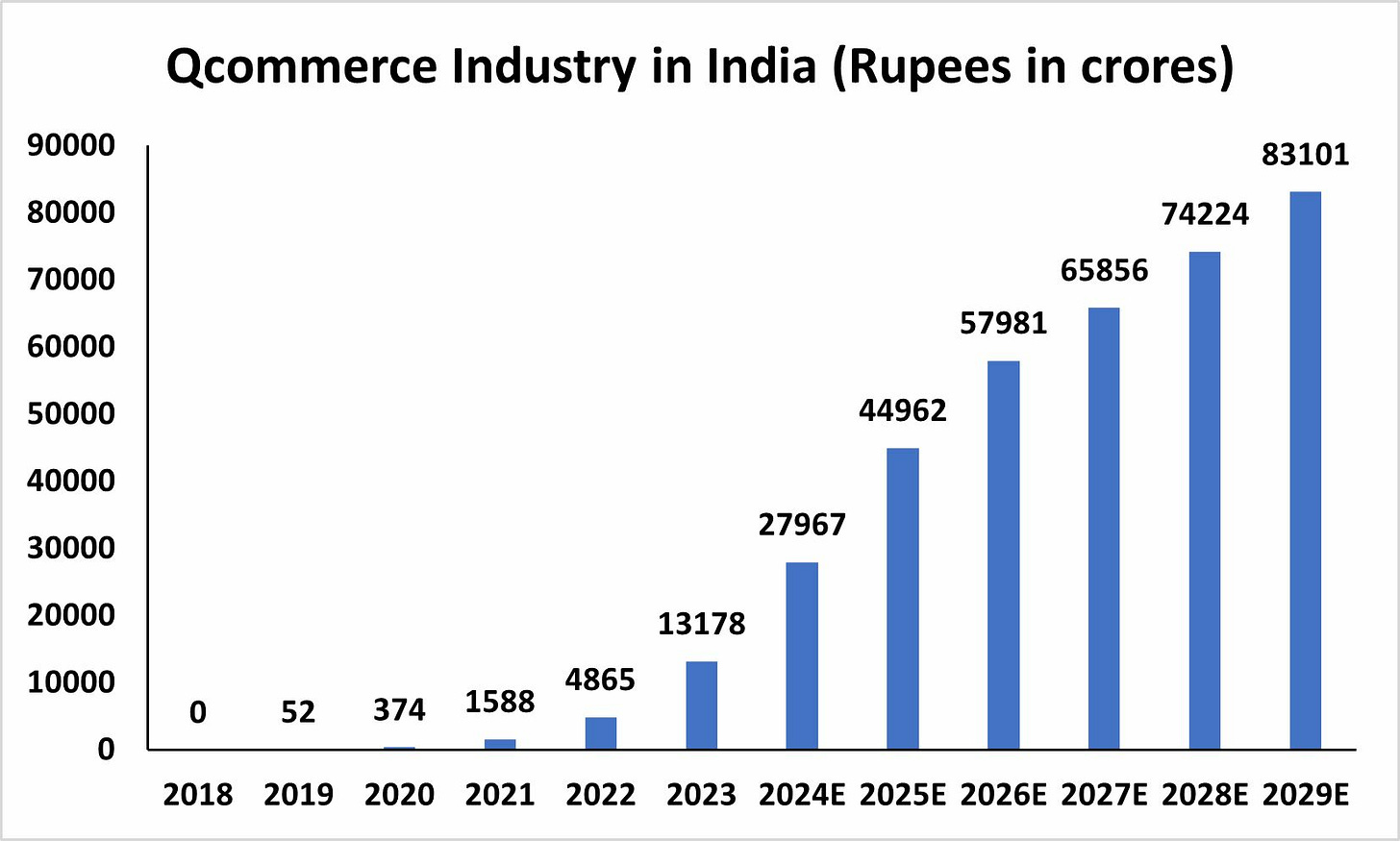

Thanks to apps like Zepto, Blinkit, and Swiggy Instamart, the quick commerce (Qcom) industry in India which has emerged in such a short time, leaving traditional retail giants like Dmart scratching their heads and wondering where they went wrong.

So, what’s the deal?

Are retail giants simply out of touch, or is the Qcom industry a balloon waiting to pop? Let’s dive into this digital drama and find out! 📦

Who knew that a pandemic would turn us all into couch potatoes with a craving for instant deliveries? (All the growth has been post covid :) )

Fast forward four years, and if my bananas take more than ten minutes to arrive, I might as well be living in the Stone Age! Seriously, who has time for that? 😤

But what exactly is the problem statement that Qcom is solving?

The answer is simple: convenience. One doesn’t want to run through those stinky bhaji markets in Dadar on a Sunday morning to buy staples when I can just summon them to my doorstep. And let’s be honest, if prices on these platforms are roughly the same as in-store, I’m more than willing to cough up a small delivery fee. Just don’t make me pay extra for the existential crisis of going to the grocery store XD. 🛒

For brands, Qcom is a breath of fresh air—or maybe a swift kick to the ego. Traditionally, brands had to navigate a web of intermediaries more complicated than my last school reunion XD. With Qcom, brands can list their products on a single platform, making distribution as easy as pie (or should I say chips?). If you find a product priced lower on Zepto, don’t assume the brand is slashing prices out of desperation; it’s just a more efficient way of doing business.

Take a ₹10 chips pack as an example: The manufacturer makes it for ₹4 and sells it to a super stockist for ₹6, who then passes it down the line until it reaches you at ₹10. In the Qcom model, the manufacturer might sell it to a platform like Zepto for ₹8, boosting their margins from 33% to 50%. And if the Qcom platform sells it for ₹9.50 instead of ₹10, it’s not a loss; it’s called being savvy! 🎉

The Global Landscape: A Different Story 🌍

Now, let’s see what has happened overseas, where the quick commerce scene looks more like a horror movie. Giants like Gorillas and Jokr have crumbled faster than my willpower in front of a plate full of Rajma Chawal.

In Western markets, existing supply chains are as tight as my jeans after a Chole Bhature binge, making it hard for Qcom to fit in. Consumers there seem to prefer a more planned approach to shopping, which is a nightmare for the impulsive snackers among us. Plus, the heavy investments needed for infrastructure—warehouses, delivery fleets—have turned many global Qcom ventures into fairy tales.

So, what makes the Qcom wave in India so resilient?

For starters, unlike the West, where supply chains are well-oiled machines, India’s are a chaotic mess. For any direct-to-consumer (D2C) brand, shifting toward Qcom makes perfect sense, even for those fancy flavored water selling brands. Major global markets are dominated by traditional retail channels, but here, Qcom platforms give brands access to a growing urban population that craves instant delivery. They can easily reach a younger, tech-savvy demographic that loves their Qcom apps. And let’s not forget about price sensitivity! Indian consumers love a good deal, and Qcom platforms let brands offer competitive prices while improving margins by cutting out unnecessary distribution layers. It’s a win-win—unless you’re a middleman, in which case, sorry not sorry. 💸

So, does this mean we should just shut everything down and dive headfirst into quick commerce in India? Sounds like a wild idea—just raise funds, burn through them, and launch a Qcom brand, right? 🤷♂️

Well, hold your horses! It’s not that easy, my friends. Execution is a tricky beast, like trying to assemble IKEA furniture without the instructions.

As I read through "Subscribed," I learned that while many players enter platform businesses, there’s a crucial phase of consolidation. It’s like a college freshers party: everyone shows up at first, but eventually, only the most resilient ones stay until the end. If I were selling aerated soft drinks, I’d prefer to sell my products on a platform where Thumbs Up or Pepsi is already a household name rather than a fledgling one with zero traction. 🥤

During my time at Solidarity Investments, we often discussed the "S curve" or learning curve that founders experience. They start at the launch point, move to the sweet spot where they grasp the landscape, and then reach mastery—where it becomes increasingly tough to beat them at their own game. Players like Zepto, Instamart, and Blinkit have navigated these cycles, raised capital, and established themselves in this market from the beginning. New players would find it incredibly challenging to leapfrog ahead on this curve. They’ve built comprehensive logistics and delivery networks that are hard to replicate, especially in urban areas. Plus, their intuitive apps and websites provide a user experience that newcomers would need to match. Seriously, it’s like trying to beat your friend at an online video game when they’ve been practicing for years—good luck with that! 📲

Final Thoughts ✨

As we speed through the whirlwind of quick commerce in India, it’s obvious things are changing faster than we can swipe. But here’s the kicker: I genuinely believe that players like Dmart will and should stick to their tried-and-true low-price game. Why? Because they’ve got a long runway ahead, and guess what—they’re not the type to set fire to their wallets. Slow and steady, folks. 💸🐢 They’re in no rush to be the “cool kids” burning through cash.

Launching new quick commerce brands in India now? Yeah, good luck with that. The first movers have already marked their territory, and they’re not exactly keen on sharing. (I’m genuinely excited for Jio’s entry into the Q-commerce game. Just imagine—ordering Thums Up at a discount.)

Here’s the brutal truth for founders: Betting too hard on quick commerce is like dating someone who's one bad paycheck away from crashing on their parents' couch. Sure, it’s a blast while the VC cash is flowing, but the second that dries up? You know who’s getting ghosted. 💸🚪 If your entire business relies on 10-minute deliveries, maybe it’s time to rethink things before you're left wondering why the lights went out. 😬💀

_________________

Till we meet again—Aavjo! And don’t forget, phir padhaar jo!

Join the Profits and Punches broadcast for receiving my blogs every Monday and Friday.

https://wa.link/ozwmcv

𝘉𝘶𝘪𝘭𝘥𝘪𝘯𝘨 𝘢 𝘴𝘵𝘢𝘳𝘵𝘶𝘱 𝘵𝘩𝘢𝘵 𝘴𝘰𝘭𝘷𝘦𝘴 𝘢 𝘱𝘳𝘰𝘣𝘭𝘦𝘮?

𝘙𝘦𝘢𝘤𝘩 𝘰𝘶𝘵 𝘵𝘰 𝘮𝘦 𝘢𝘵 𝘥𝘩𝘳𝘶𝘷.𝘳𝘢𝘵𝘩𝘰𝘥@𝘪𝘱𝘷𝘦𝘯𝘵𝘶𝘳𝘦𝘴.𝘪𝘯 – 𝘞𝘦’𝘥 𝘭𝘰𝘷𝘦 𝘵𝘰 𝘦𝘹𝘱𝘭𝘰𝘳𝘦 𝘩𝘰𝘸 𝘸𝘦 𝘤𝘢𝘯 𝘢𝘴𝘴𝘪𝘴𝘵 𝘺𝘰𝘶 𝘪𝘯 𝘺𝘰𝘶𝘳 𝘫𝘰𝘶𝘳𝘯𝘦𝘺! 🌱